Reduce risk—proactive chargeback protection for merchants

Preventing chargeback losses isn’t just about responding to disputes—it’s about proactively shielding your business from risk at its source

The MidMetrics™ suite of dispute prevention tools equip your team with the clarity and foresight they need to intercept chargebacks before they happen, avoiding profit erosion while simultaneously maintaining a positive customer experience.

Scalable, end-to-end chargeback prevention software

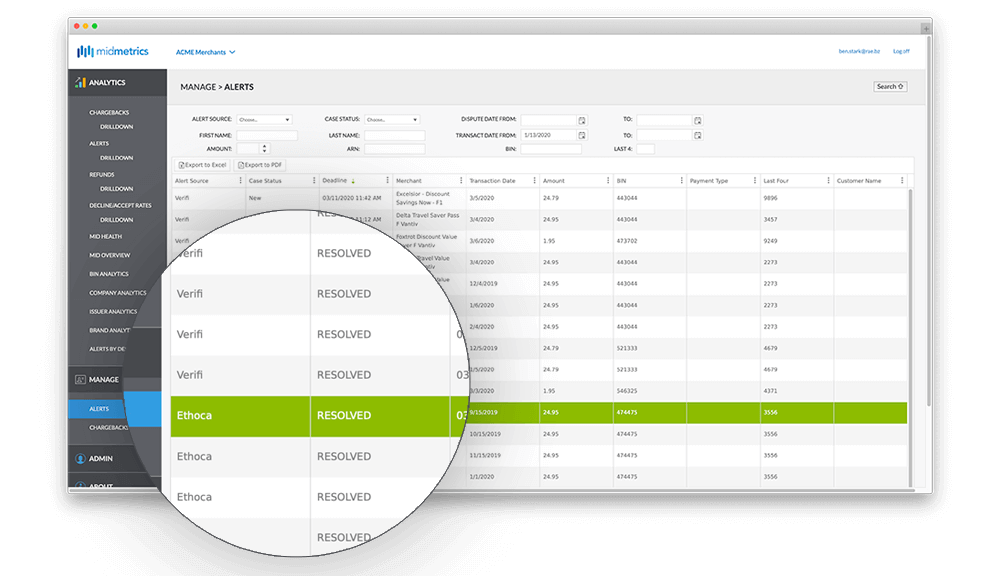

Chargeback alerts (Verifi alerts & Ethoca alerts)

Be the first to know about and prevent potential disputes with real-time chargeback prevention alerts. MidMetrics™ all-in-one platform integrates seamlessly with industry leaders Verifi and Ethoca, preparing your team to address and reduce chargebacks proactively. Verifi and Ethoca send impending disputes to MidMetrics™ so you can manage all alerts in one place, reducing your tech stack. With MidMetrics™ chargeback prevention suite, you get faster, actionable chargeback mitigation at your fingertips.

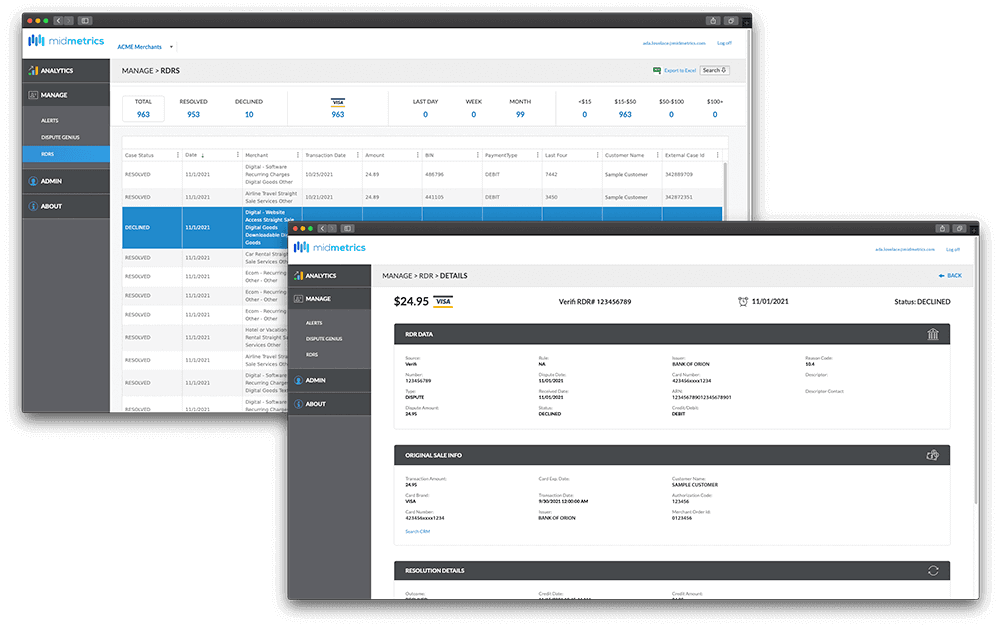

Rapid Dispute Resolution (RDR)

Take back control with Visa’s Rapid Dispute Resolution (RDR). RDR automatically resolves select Visa disputes in seconds, based on rules you define, saving time, reducing effort, and cutting through the complexity of managing your chargebacks. As the first chargeback management company to integrate RDR, MidMetrics™ joins innovation and agile solutions, empowering you to proactively protect your revenue. Experience a smarter, more efficient approach to dispute resolution with MidMetrics™ RDR integration and our comprehensive chargeback prevention suite.

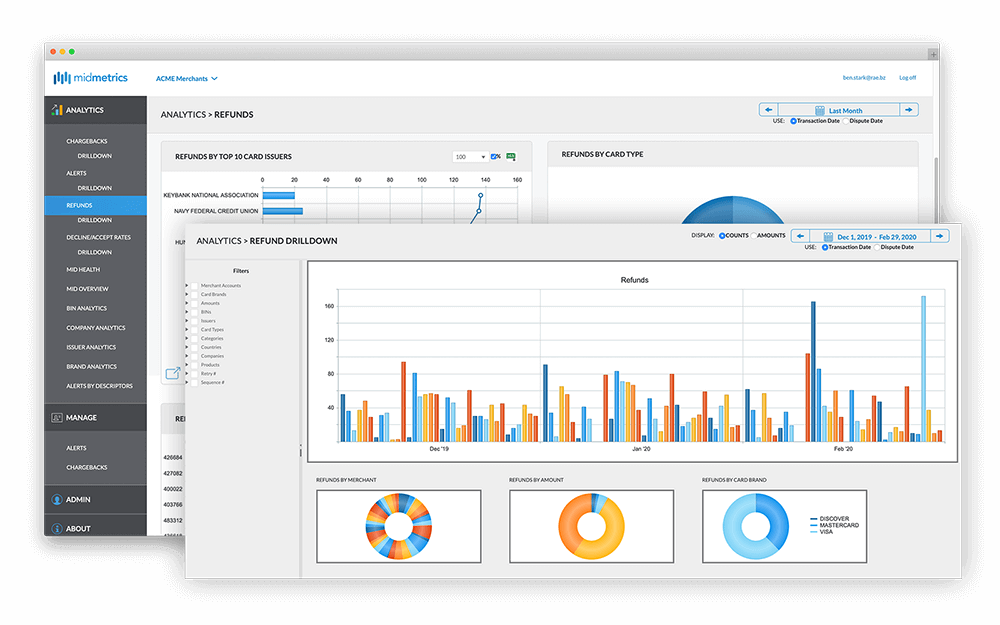

Identify root causes to prevent chargebacks

They say the best offense is a good defense. Credit card chargeback protection goes beyond alerts and RDR—understanding where your disputes originate allows you to reduce dispute losses, reduce operational friction, and enhance the customer experience. Find out what is driving your customers to dispute with complete visibility into approvals, declines, refunds, disputes, alerts, RDR, and your VAMP ratio metrics across your entire portfolio or just one MID—all in one easy-to-use platform. Analyze patterns and implement forward-thinking, preventative strategies to safeguard future revenue. With MidMetrics™ prevention tools and techniques, advanced analytics and customizable reporting features, you have the data you need to make informed decisions in an instant.

White glove chargeback prevention services

Unlike other chargeback solution providers, MidMetrics™ doesn’t force you to fit into a rigid system. We offer fully customizable prevention services tailored to your business. Manage alerts yourself or let our team handle them based on your preference. Refund only select transactions or test RDR on a low-volume MID before broader implementation. Collaborate with us to execute the ideal bespoke prevention blueprint that aligns with your goals. With MidMetrics™, you are in control.

Key features of MidMetrics™

Accept and refund alerts

Reduce friendly fraud

Managed services

Prevent duplicate alerts

Automatically resolve disputes

Easily manage VAMP ratios

Comprehensive, results-driven solutions

Chargeback Management

Chargeback Management

Recover more, save more, and do more with your data—all in one place

Learn MoreChargeback Representment

Chargeback Representment

Streamline workflows and manage disputes effortlessly with DisputeGenius™

Learn MoreDispute Orchestration & Intelligence

Dispute Orchestration & Intelligence

Understand the nature and sources of your chargebacks to protect revenue

Learn MoreChargeback Prevention

Chargeback Prevention

Prevent chargebacks and protect merchant accounts in real-time with alerts

Learn MoreRapid Dispute Resolution (RDR)

Rapid Dispute Resolution (RDR)

Automated chargeback dispute resolution, saving time and operating costs

Learn MoreVisa Acquirer Monitoring Program (VAMP)

Visa Acquirer Monitoring Program (VAMP)

MidMetrics™ can divert potential chargebacks and help reduce your VAMP ratio

Learn MoreWhy MidMetrics™

Why MidMetrics™ is the best chargeback company

Experience that matters

Developed by merchants

Stop chargebacks at the source

End-to-end protection

Experience that matters

Drawing on more than 20 years of merchant experience, we developed a suite of chargeback tools that fit the needs of merchants that had been left unaddressed by existing chargeback providers

Book a Demo

Developed by merchants

MidMetrics™ was developed for our own merchant businesses to reduce chargebacks and friendly fraud. Now the same powerful, real-time adaptive tool for monitoring MIDs' health and keeping track of chargebacks is available to you

Book A Demo

Stop chargebacks at the source

Reduce fraudulent transactions, fraud costs, and future chargebacks. There is nothing else on the market that provides the level of control and depth of valuable information like our dashboards for chargeback reduction

Book a DemoEnd-to-end protection

MidMetrics™ is the only provider that offers analytics dashboards, chargeback prevention alerts, and a representments solution together in a single platform

Book a Demo