WEBINAR: Deep Dive into Visa's VAMP

Join us Wednesday, March 26th @ 12:30pm EST for a deep dive into Visa’s VAMP (Visa Acquirer Monitoring Program) and what it means for merchants.

Register Now

Easily comply with Visa's Acquirer Monitoring Program (VAMP)

Keep your VAMP ratios under control

Monitor VAMP ratio and more with VAMP View™

When it comes to safeguarding your processing capabilities, staying within Visa’s VAMP thresholds is crucial. A high VAMP ratio can jeopardize MIDs, lead to costly penalties, and disrupt your ability to process Visa transactions. VAMP View™ provides instant visibility into your VAMP ratios, dispute activity, and fraud trends, helping you spot high-risk MIDs before issues escalate. Protect your processing relationships, maintain compliance, and keep payment operations running smoothly.

.png?width=712&height=387&name=image%20(4).png)

Resolve disputes without impacting VAMP ratios

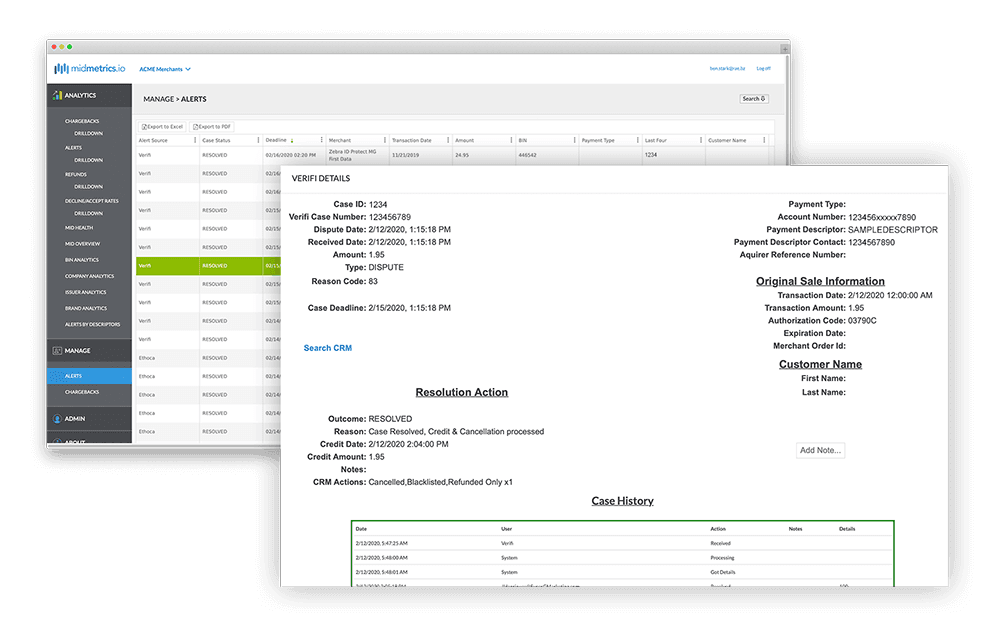

Visa-specific solutions like Cardholder Dispute Resolution Network (CDRN) and Rapid Dispute Resolution (RDR) help merchants resolve disputes without impacting VAMP ratios. MidMetrics™ all-in-one platform integrates seamlessly with both Ethoca and Verifi CDRN alerts, and Visa's RDR, empowering your team to protect revenue by proactively addressing and reducing chargebacks.

Key features of MidMetrics™

Real-time monitoring

Keep MIDs healthy

Visa-specific prevention

Processing protection

Deep insights

Real-time precision

Comprehensive, results-driven solutions

Chargeback Management

Chargeback Management

Recover more, save more, and do more with your data—all in one place

Learn MoreChargeback Representment

Chargeback Representment

Streamline workflows and manage disputes effortlessly with DisputeGenius™

Learn MoreDispute Orchestration & Intelligence

Dispute Orchestration & Intelligence

Understand the nature and sources of your chargebacks to protect revenue

Learn MoreChargeback Prevention

Chargeback Prevention

Prevent chargebacks and protect merchant accounts in real-time with alerts

Learn MoreRapid Dispute Resolution (RDR)

Rapid Dispute Resolution (RDR)

Automated chargeback dispute resolution, saving time and operating costs

Learn MoreVisa Acquirer Monitoring Program (VAMP)

Visa Acquirer Monitoring Program (VAMP)

MidMetrics™ can divert potential chargebacks and help reduce your VAMP ratio

Learn MoreWhy MidMetrics™

Why use MidMetrics™

Experience that matters

Developed by merchants

Stop chargebacks at the source

End-to-end protection

Experience that matters

Drawing on more than 20 years of merchant experience, we developed a suite of chargeback tools that fit the needs of merchants that had been left unaddressed by existing chargeback providers

Book a Demo

Developed by merchants

MidMetrics™ was developed for our own merchant businesses to reduce chargebacks and friendly fraud. Now the same powerful, real-time adaptive tool for monitoring MIDs' health and keeping track of chargebacks is available to you

Book a Demo

Stop chargebacks at the source

Reduce fraudulent transactions, fraud costs, and future chargebacks. There is nothing else on the market that provides the level of control and depth of valuable information like our dashboards for chargeback reduction

Book a DemoEnd-to-end protection

MidMetrics™ is the only provider that offers analytics dashboards, chargeback prevention alerts, and a representments solution together in a single platform

Book a DemoFrequently Asked Questions

What is VAMP?

The Visa Acquirer Monitoring Program (VAMP) is set to replace Visa’s Fraud Monitoring Program (VFMP) and Dispute Monitoring Program (VDMP), creating a unified framework that monitors both fraud and non-fraud chargeback activity across the Visa ecosystem.

Key Visa Dispute Monitoring Updates

- Unified Metrics: VAMP introduces a consolidated ratio that includes fraud cases (TC40) and non-fraud disputes, creating a more holistic view of risk

- Introduction of VAMP Ratio: This new metric combines reported fraud and non-fraud chargebacks to provide a comprehensive view of a merchant's risk profile

- Enumeration Ratio Monitoring: A new metric targets brute-force attacks involving card enumeration fraud

- Global Application: While initial pilots focused on Europe, the program extends to all regions, including the U.S., Canada, LAC, AP, and CEMA

- Acquirer Responsibility: To avoid the potential for financial penalties or compliance assessments, acquirers must now even more closely monitor dispute and fraud activity in their merchants' portfolios

Why are these Visa fraud monitoring changes happening?

Visa's primary goal is to combat fraud, enhance transparency, and ensure accountability at every level of the payment chain. By introducing stricter thresholds and additional metrics, Visa hopes to reduce financial risks and improve the integrity of its network.

How does the VAMP Ratio work?

The VAMP Ratio measures fraud and non-fraud disputes against the total number of settled transactions:

- VAMP Ratio = Monthly Card-Absent Disputes / Monthly Settled Transactions

Additionally, Visa has introduced the VAMP Enumeration Ratio to monitor brute-force card enumeration attacks:

- VAMP Enumeration Ratio = Monthly Enumerated Transactions / Monthly Enumerated Transactions

Enumeration

Enumeration is the criminal practice of testing stolen payment information, usually conducted at scale via technology. Enumeration is commonly referred to as brute force attacks, card testing attacks, or BIN attacks.

Thresholds

The tightened thresholds significantly heighten the compliance burden for merchants, making it more difficult to avoid penalties or account closures for merchants who struggle with dispute management.

VAMP Ratio Compliance for Merchants

Starting April 1, 2025, merchants will need to maintain a VAMP Ratio below 1.5%. This merchant threshold will tighten to 0.9% by January 2026. Exceeding these limits could result in fines or restrictions on processing Visa payments.

- VAMP Ratio ≥ 1.5% for U.S., Canada, Europe, CEMA, and AP regions

- VAMP Ratio ≥ 0.9% for LAC

- Merchants must have at least 1,000 disputes in a month to be enrolled

Visa Acquirer Thresholds

The program will identify acquirers with portfolio-wide VAMP ratios exceeding 0.5% and hold them accountable for managing merchant risk.

Minimums

The VAMP announcement also outlines minimums.

- An acquirer is only enrolled in VAMP if its portfolio has received 1,000 or more card-absent disputes (fraud and non-fraud combined) in the given month.

- A merchant is only enrolled in VAMP if it has received 1,000 or more card-absent disputes (fraud and non-fraud combined) in a given month.

What are the merchant implications for Visa fraud and dispute monitoring updates?

The introduction of VAMP presents both challenges and opportunities for merchants. While the program’s stricter monitoring aims to reduce fraud and disputes, it also requires merchants to be more vigilant about their practices. High-risk industries such as adult entertainment, CBD, gaming, and subscription services will need to pay particular attention to compliance.

- Higher Ratios: Including TC40 fraud cases alongside disputes could significantly increase merchant ratios, especially when fraud resolution is incomplete

- Enumeration Monitoring: Merchants must adopt robust pre-authorization fraud tools to avoid penalties for enumeration attacks

- Increased Oversight: Acquirers must actively monitor merchants and take steps to prevent breaches or face penalties themselves

- Fee Transparency: While Visa's penalty fees are published, acquirers may add administrative costs, increasing the financial burden on merchants

How to prepare for Visa VAMP 2025?

2025 Visa Compliance

The introduction of VAMP marks a significant shift in how Visa monitors and manages fraud and disputes. By proactively addressing these changes, merchants can not only avoid penalties but also contribute to a safer and more reliable payment ecosystem. Staying informed, leveraging technology, and adhering to best practices like the following will be key to navigating this new landscape successfully:

- Leverage Visa's Tool: Programs like Cardholder Dispute Resolution Network (CDRN) and Rapid Dispute Resolution (RDR) help merchants resolve disputes without impacting VAMP ratios. However, tools like Ethoca may not offer the same benefits, highlighting the importance of using Visa-specific solutions

- Invest in Fraud Prevention: Advanced tools to block card enumeration attacks and detect pre-authorization fraud are vital to preventing VAMP identification under the new enumeration ratio metric

- Monitor Metrics Regularly: Merchants and acquirers must actively track VAMP ratios and disputes to ensure compliance. Early detection and mitigation can prevent enrollment in the program. Early detection and proactive management can help prevent enrollment in the program and avoid costly penalties