Visa's Acquirer Monitoring Program (VAMP): What to Know for 2025

By Amber McGirr on Mar 7, 2025 9:15:55 AM

What is VAMP?

Visa is making significant updates to its risk monitoring programs, consolidating them into an enhanced Visa Acquirer Monitoring Program (VAMP). On May 9, 2024, Visa revealed its plan to consolidate its existing fraud and dispute programs into a single, streamlined system, with the aim of simplifying compliance and enforcement while strengthening fraud prevention measures. These changes go into effect April 1, 2025.

On March 11, 2025, just 20 days before the rule change, Verifi announced that Visa will now include disputes with corresponding TC40 records (fraud disputes) resolved with Rapid Dispute Resolution (RDR) and Cardholder Dispute Resolution Network (CDRN) in VAMP calculations.

Previously, Visa stated these resolved disputes would not count toward a merchant's VAMP ratio. This last-minute shift means merchants could now see higher VAMP ratios than anticipated, potentially triggering program identification, increased scrutiny, and risk-based enforcement fees.

Verifi maintains that CDRN and RDR continue to add value by removing fraud and non-fraud disputes from the ecosystem. However, because Visa has opted to include fraud disputes resolved via these channels, merchants must now be even more vigilant in managing fraud risk and preventing unnecessary disputes from occurring in the first place.

Here's what you need to know.

What's Changing with VAMP?

In response to the evolving payments landscape, Visa's upcoming VAMP enhancements aim to reduce risk, ensuring acquirers and merchants have proper oversight to prevent fraudulent activity, ultimately creating a safer payment ecosystem for all stakeholders. The enhancements introduce:

-

A Unified Fraud & Dispute Monitoring Program – Visa is replacing VDMP and VFMP with VAMP as a singular, comprehensive system

-

New Standard and Excessive Thresholds – Visa holds merchants and acquirers to different thresholds under the VAMP program

-

Risk-Based Enforcement – Instead of fixed non-compliance fees, Visa will implement risk-based enforcement based on VAMP-qualified disputes

New VAMP Criteria

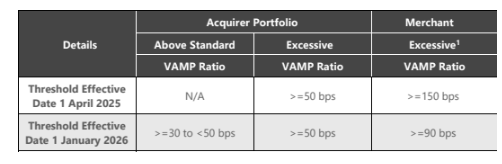

Starting April 1, 2025, Visa will monitor acquirers and merchants using the following thresholds:

What is VAMP Ratio?

The sum of card-absent (number of card-absent fraud + number of non-fraud disputes) divided by the number of settled transactions.

There are some intricacies to calculating your VAMP ratio because:

-

Visa considers only card-absent transactions in VAMP calculations

-

A monthly minimum of 1,000 combined fraud and non-fraud disputes applies to the acquirer and merchant thresholds

-

The Excessive Identification level for merchants applies only if their acquirer's VAMP Ratio is below 0.3% (30 basis points)

Effective January 1, 2026, Visa will implement even stricter thresholds for acquirers:

-

Above Standard: Acquirers with a VAMP ratio between 0.3% and 0.5%

-

Excessive: Acquirers with a VAMP ratio of 0.5% or higher

The 2026 thresholds are more stringent than the initial criteria set for 2025, so acquirers will be under increased pressure to maintain lower fraud and dispute ratios. Consequently, merchants may experience heightened scrutiny and must implement more robust fraud prevention and dispute management strategies to align with the tightened standards.

New Enforcement Structure

For merchants struggling to manage fraud and dispute levels, Visa's VAMP enhancements may mean stricter oversight from their acquirers and potential financial consequences. With new risk-based enforcement, merchants must adopt more substantial fraud prevention and dispute mitigation strategies to avoid penalties. Since fees for non-compliance range from $5 to $10 per fraudulent or disputed transaction, failing to meet Visa's thresholds could significantly impact profitability.

For first-time identifications in a 12-month period, Visa will still provide a 6-month grace period, allowing those identified to reduce their dispute and fraud activity before enforcement (e.g., compliance fees) begins. Merchants who consistently exceed Visa's thresholds may face more rigorous monitoring. Acquirers may require closer collaboration on remediation plans and could impose potential restrictions or pass compliance fees down to merchants, given the stricter acquirer thresholds.

Visa will provide a 6-month advisory period (April 1 – September 30, 2025) before enforcement (e.g., compliance fees) begins October 1, 2025.

We expect acquirers to respond by:

-

Reviewing and strengthening fraud and dispute management strategies

-

Assessing merchant activity that could contribute to high dispute ratios

-

Ensuring compliance with Visa rules to avoid future program identifications

During this time, merchants with ratios near the VAMP thresholds can attack issues proactively by:

-

Enrolling their MIDs in Visa's INFORM and/or Order Insight

-

Gaining clarity on their VAMP ratios

-

Identifying and filling gaps in processes that could lead to disputes

-

Implementing strong fraud prevention measures before enforcement

How MidMetrics™ Can Help

Visa's VAMP update highlights the growing importance of real-time fraud and dispute monitoring. Now more than ever, businesses must take an immediate, proactive approach to fraud prevention and KYC to maintain a strong reputation in the payments ecosystem.

MidMetrics™ is launching VAMP View™, the only tool offering real-time visibility into dispute metrics impacting your VAMP ratio. With daily, weekly, and monthly insights into dispute activity, VAMP View™ equips merchants with the tools to stay compliant, avoid penalties, and safeguard their business.

By leveraging advanced analytics, businesses can stay ahead of compliance requirements, reduce fraud exposure, and ensure a seamless experience for cardholders. With Visa's stricter enforcement approaching, merchants who stay informed and adapt quickly will position themselves for long-term success.