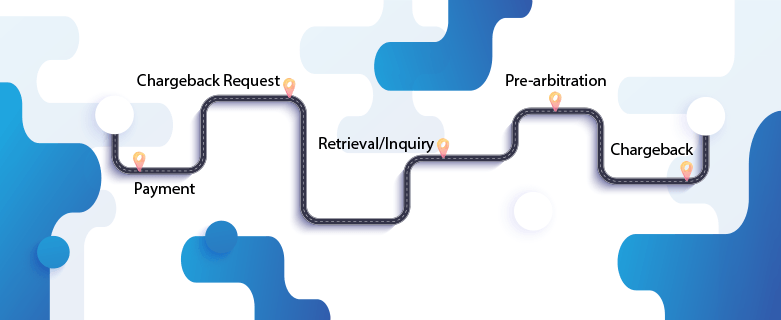

Journey of a Payment Dispute

By Chris Alarie on Jan 6, 2021

“A journey is like marriage. The certain way to be wrong is to think you control it.”

― John Steinbeck, Travels with Charley: In Search of America

For a merchant, the experience of managing a payment dispute can be a lesson in just how little of their business is fully within their control. From the number of entities involved to the multiple, various processes that can constitute a payment dispute, it can be a truly bewildering journey. This article serves not to simplify the unsimplifiable but to explain the complexities of the chargeback process.This article will outline the general process by which a payment dispute proceeds. However, each card brand has specific procedures that they tend to follow. And even within a particular card brand’s procedures, there are a number of decisions and pathways that can dramatically change the shape of the payment dispute. We will try to indicate as many of these possibilities as possible but it would serve the reader well to think of this more as a detailed but loose overview rather than a set, step-by-step guide.

An important note about terminology: the “issuer” refers to the cardholder’s bank while the "acquirer" refers to the merchant’s bank. “Card Brand” refers to the companies such as Visa, MasterCard, or American Express that facilitate credit card and debit card payments by lending funds to merchants and seeking reimbursement from cardholders.

Payment

Any payment dispute has to start with a payment. In terms of the interactions between the acquirer and the issuer, this step is known as presentment. The acquirer submits transaction data to the issuer to receive payment, which the issuer then remits.

This step is a part of every payment card transaction, whether disputed or not. For disputed payments, the process continues as described below. Note that, at nearly any point in this process, one of the involved parties—merchant, acquirer, cardholder, or issuer—may choose to withdraw and accept the results as they stand.

Chargeback Request

There are two kinds of chargebacks, with the more prominent of the two being cardholder-initiated chargebacks. There are a number of reasons why a cardholder may request a chargeback, including:

-

The goods were not received or were materially different from what the cardholder had expected.

-

The charge resulted from merchant error or included some sort of incorrect information, such as the wrong purchase amount.

-

The charge was the result of criminal fraud and not made by the cardholder.

-

The cardholder is committing intentional chargeback fraud.

-

The cardholder is committing unintentional, friendly fraud.

The other form of chargeback is one that is initiated by the issuer. These are known as “bank chargebacks” and are relatively rare. They usually occur if the issuer recognizes something suspicious or errant about a transaction.

The issuer may choose to immediately transmit this chargeback request to the acquirer or they may opt to investigate the charge before doing so, with different card brands having different tendencies and procedures.

Retrieval/Inquiry

This is the procedure in which the issuer investigates a charge before formally requesting a chargeback on behalf of the cardholder. Not every issuer performs this process for every chargeback, and the likelihood and frequency of it being completed depends on the card brand. Issuers rarely perform the retrieval process for Visa and MasterCard transactions but almost always do so for Discover and American Express transactions. For American Express transactions, the retrieval process is referred to as an “inquiry.”

For Discover and American Express transactions, this is the most important part of the chargeback process. It is when the issuer and acquirer share the bulk of their information about the transaction and a decision is reached as to whether or not the chargeback will be processed. If the cardholder still wishes to continue a dispute after reviewing the information in the retrieval request, a chargeback will be filed and the merchant can respond with all of the compelling evidence on file.

Pre-Arbitration

Issuers generally forgo retrievals for Visa and MasterCard transactions because those card brands use a process known as pre-arbitration as the centerpiece of their payment dispute management process. Pre-arbitration involves a series of steps in which the issuer and acquirer exchange information about the transaction in hopes of reaching a resolution. If no resolution is reached, the case proceeds to an arbitrator whose decision is final.

As with everything related to chargebacks, the actual details of how pre-arbitration works are complex and contingent on various scenarios and decisions. In fact, Visa has two distinct pre-arbitration workflows, known as allocation and collaboration.

In MasterCard’s pre-arbitration and in Visa’s collaboration workflow pre-arbitration, the process works as follows:

-

First Presentment: As described above, the acquirer submits transaction data to the issuer to receive payment, which the issuer then remits.

-

Chargeback: The issuer disputes the transaction, and the payment from step 1 is removed from the acquirer’s account.

-

Second Presentment: Also known as representment, the acquirer presents evidence to dispute the chargeback.

-

Pre-Arbitration Case Filing: The chargeback process having been completed, the issuer disputes some aspect of the second presentment.

-

Pre-Arbitration Response: Having received the case filing, the acquirer can either choose to accept or deny liability. If the acquirer accepts liability, the process ends here. If the acquirer does not accept liability, they rebut the case and send it to arbitration.

-

Arbitration: The issuer and acquirer each present their side of the case to the card brand, who assigns responsibility. Whichever side loses is also required to pay all fees.

Visa’s allocation workflow eliminates the representment stage and reverses the dynamic such that the acquirer, rather than the issuer, files for pre-arbitration. We have more detailed articles about how pre-arbitration works for MasterCard and Visa transactions.

Chargebacks

The chargeback itself is the mechanism for returning payment to the cardholder as a result of the disputed credit or debit card charge. Unlike a refund, a chargeback does not involve the direct communication of customer and merchant but, rather, involves the communications between issuer and acquirer as described above. The chargeback is the actual transfer of payment from the acquirer back to the issuer.

A key difference between card brands is the point at which the chargeback actually occurs in the dispute process. Generally, for transactions involving American Express or Discover, the chargeback occurs later in the process, after the retrieval or inquiry has been completed. For Visa and MasterCard transactions, the chargeback occurs comparatively early in the process, with the payment being removed from the merchant’s account shortly after the cardholder files for a chargeback and before pre-arbitration.

Win More Disputes with the Right Tools

The clearest lesson from this article is that chargebacks are complicated. They cost merchants time and money in operational costs. Depending on the card brand, they can involve money being temporarily removed from merchants’ accounts even for chargeback disputes that they win. And no merchant is going to win every chargeback dispute. Additionally, fees are charged to merchants for unsuccessful and successful chargebacks alike. Compounding these costs are the risks of a merchant running up too high of a chargeback ratio, something that is calculated based on the number of chargebacks filed, regardless of win rate for chargeback disputes.

The only way to protect your business from the risks associated with chargebacks is to avail yourself of all the tools and procedures at your disposal to prevent chargebacks before they happen.

Want to see MidMetrics in action? Schedule a demo with us.