Are you prepared for Visa's VAMP?

The new Visa Acquirer Monitoring Program is a shift merchants and processors need to understand. Learn about the calculations, what’s coming, and how to prepare.

Learn More

See what's behind your chargebacks. Minimize future risk.

Schedule a Chargeback Risk Review today.

Schedule My Risk ReviewMerchant protection from chargebacks, high risk, and revenue loss

Empower teams with complete transparency and seamless management of merchant chargebacks

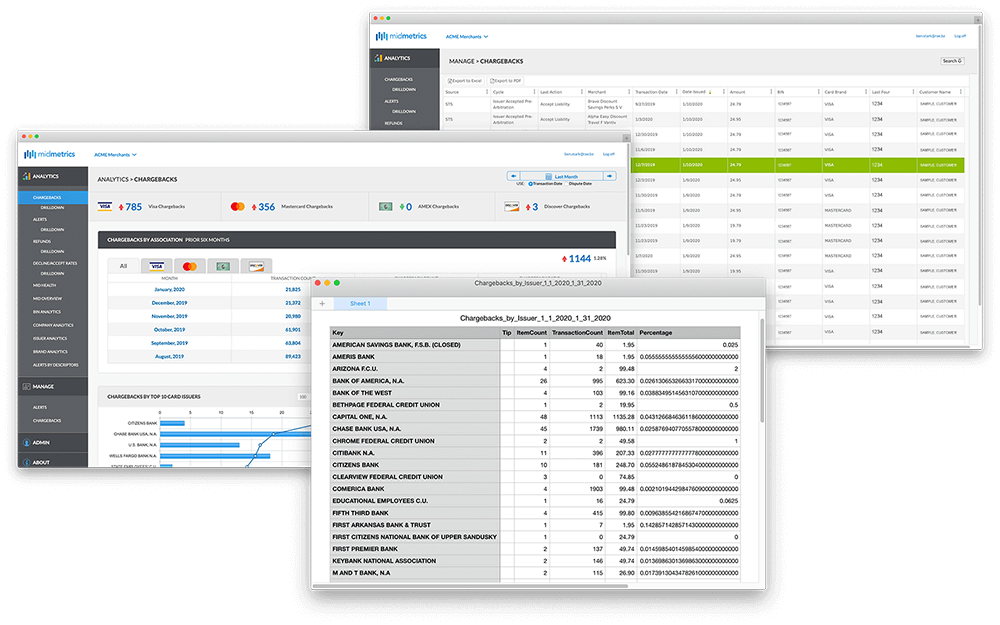

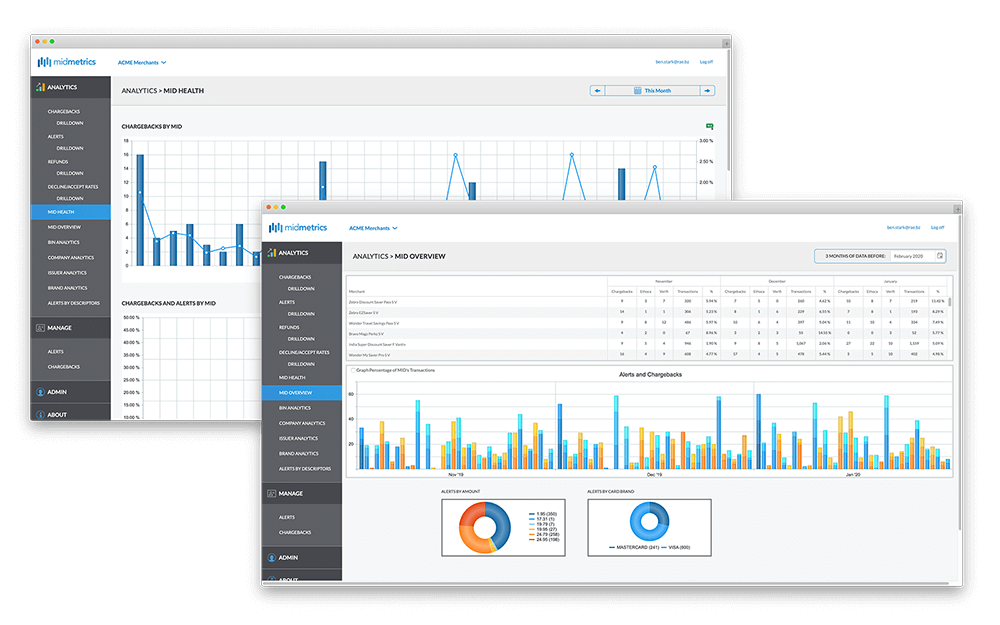

MidMetrics™ real-time dashboards and customizable reporting show every detail of credit card transactions and disputes, allowing merchants to prevent fraud, risk, and recurring issues throughout the entire customer journey. Tailor workflows to your needs and scale across brands, MIDs, and locations.

Scalable, end-to-end chargeback software

Optimize siloed systems into strategic insights

Manage payments, risk, chargebacks, and disputes with one chargeback system. MidMetrics™ brings together merchant accounts, gateways, and fraud prevention tools into a single platform so your teams—from payments to risk to chargebacks—can finally see the whole story, connect the dots, and make smarter decisions. And it doesn’t require a heavy lift from your IT team.

Gain full control of your MIDs

Juggling multiple systems—payment processor portals, gateways, CRMs, and more—can lead to gaps you might not even notice. Key insights slip through the cracks, reporting feels like guesswork, compliance gets tricky, inefficiencies waste time and resources, decisions get delayed, and your strategy turns reactive instead of proactive. Fraud and chargebacks? Even harder to catch. MidMetrics™ brings all your MIDs into one place, giving you the visibility and control you need to keep your payment strategy sharp and risks low.

Enhance your in-house merchant chargeback process

MidMetrics™ empowers your in-house team to handle up to 3x the workload without adding headcount. Safeguard sensitive information, maintain your unique processes, and protect your brand reputation while scaling efficiently. Our platform improves win rates, reduces chargeback rates, minimizes revenue loss, and enhances fraud prevention, risk management, and ROI. Use your own templates and systems with smoother operations and cost-effective scalability—or let us handle it for you!

Replace manual processes with chargeback automation

Every chargeback represents a drain...on your time, resources, and bottom line. Managing disputes manually can be a slow, inconsistent process, and impossible to scale. With MidMetrics™, you can automate away the bottlenecks, simplify complex workflows, and recover more revenue—without adding headcount or overhead. The MidMetrics™ platform empowers your team to work smarter, not harder, turning what was once a painful process into a strategic advantage. Whether you’re managing chargebacks in-house or need flexible support, MidMetrics has the tools to deliver better results with less effort.

Expert chargeback services, when you need them

MidMetrics™ takes chargeback management off your plate with a full-service solution designed to reduce overhead and recover more revenue. We build customized templates and craft robust dispute responses using our proprietary logic, maximizing win rates while minimizing chargeback-related losses. Let us handle the heavy lifting so you can focus on growing your business, knowing your chargebacks are managed with precision and care.

Key features of MidMetrics™

Your data, your way

Get geeky with it

Alerts analytics

Export reports

Chargeback accounting

Pre-filled data

Comprehensive, results-driven chargeback solutions

Chargeback Management

Chargeback Management

Recover more, save more, and do more with your data—all in one place

Learn MoreChargeback Representment

Chargeback Representment

Streamline workflows and manage disputes effortlessly with DisputeGenius™

Learn MoreDispute Orchestration & Intelligence

Dispute Orchestration & Intelligence

Understand the nature and sources of your chargebacks to protect revenue

Learn MoreChargeback Prevention

Chargeback Prevention

Prevent chargebacks and protect merchant accounts in real-time with alerts

Learn MoreRapid Dispute Resolution (RDR)

Rapid Dispute Resolution (RDR)

Automated chargeback dispute resolution, saving time and operating costs

Learn MoreVisa Acquirer Monitoring Program (VAMP)

Visa Acquirer Monitoring Program (VAMP)

MidMetrics™ can divert potential chargebacks and help reduce your VAMP ratio

Learn MoreWhy MidMetrics™

Why MidMetrics™ is the best chargeback company

Experience that matters

Developed by merchants

Stop chargebacks at the source

End-to-end protection

Experience that matters

Drawing on more than 20 years of merchant experience, we developed a suite of chargeback tools that fit the needs of merchants that had been left unaddressed by existing chargeback providers

Book a Demo

Developed by merchants

MidMetrics™ was developed for our own merchant businesses to reduce chargebacks and friendly fraud. Now the same powerful, real-time adaptive tool for monitoring MIDs' health and keeping track of chargebacks is available to you

Book a Demo

Stop chargebacks at the source

Reduce fraudulent transactions, fraud costs, and future chargebacks. There is nothing else on the market that provides the level of control and depth of valuable information like our dashboards for chargeback reduction

Book a DemoEnd-to-end protection

MidMetrics™ is the only provider that offers analytics dashboards, chargeback prevention alerts, and a representments solution together in a single platform

Book a Demo